I found that transferring money was such a simple concept. A concept that could be executed quickly and efficiently, benefiting millions globally. However, it is currently slowed down by financial institutions and flooded with hidden fees.

I decided to build upon the current framework around money transfer. A conservative estimate shows that it can be at least 72x faster than traditional services.

The competitive space of this product has a lot to improve on as most products currently deal with intermediaries who take a slice out of the money transfer while taking more time processing the transaction. Our product currently eliminates the need for these intermediaries, thereby reducing fees and vastly improving the speed at which money is sent.

The issue with the current model is that it requires at least 3 intermediaries to operate; the 2 banks on both ends of the transaction and the money transfer platform ie. Western Union, Paypal, etc. My product leverages the blockchain so that the only intermediary is Ethereum, a popular and widely used currency.

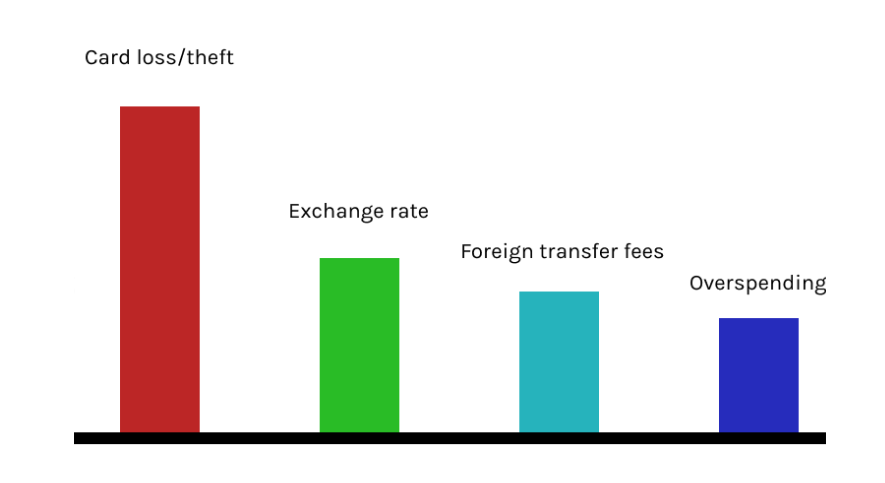

Biggest international credit card worries:

Card loss/theft: 47%

Exchange Rate: 24%

Foreign transaction fees: 18%

Overspending: 11%

3/4 of the biggest issues were related to the cost of transactions.

WalletHub conducted a nationally representative online survey:

Our landing page features our two products ChakraTransfer and ChakraPayroll.

Developers can learn about our technology and contribute to our API.

People can reach out for help by contacting our support team and a FAQ section for questions.

1.png)

2.svg)

.svg)

2.svg)

2.svg)

Something to keep in mind is that the blockchain is more of a novel concept and users can be hesitant to use this technology. I have done my best by including pieces of information and disclaimers throughout the user flow without interfering with the mental model of the user. I have experimented with the usage of tooltips however the popups were found to be detrimental to the user’s flow.

I consulted some thought leaders in the field for feedback on the flow, including designers at the Bank of America, Paypal, Citibank, and Coinbase. Here are some of the screens that I improved with their feedback.

For the new iteration, we added the balance next to the card and wallet so the user knows if they have enough money

For the new iteration, we moved the send and request money to the dashboard rather than have it take up in an entire screen in the flow to simplify the customer journey and process

For the new iteration, we removed tooltips and added a descriptive blurb below the title as there are more proximity and popups are unneeded, feeling out of place in the old iteration

For the new iteration, I removed monthly balance and your transaction in progress as users won’t want to see how much money they lost or gained and your transaction in progress isn’t needed